Kosovo is the main investor in Albania this year. Bank of Albania data show that investments from Kosovo for the third quarter reached a record figure of 90 million euros, four times more compared to the same period a year ago.

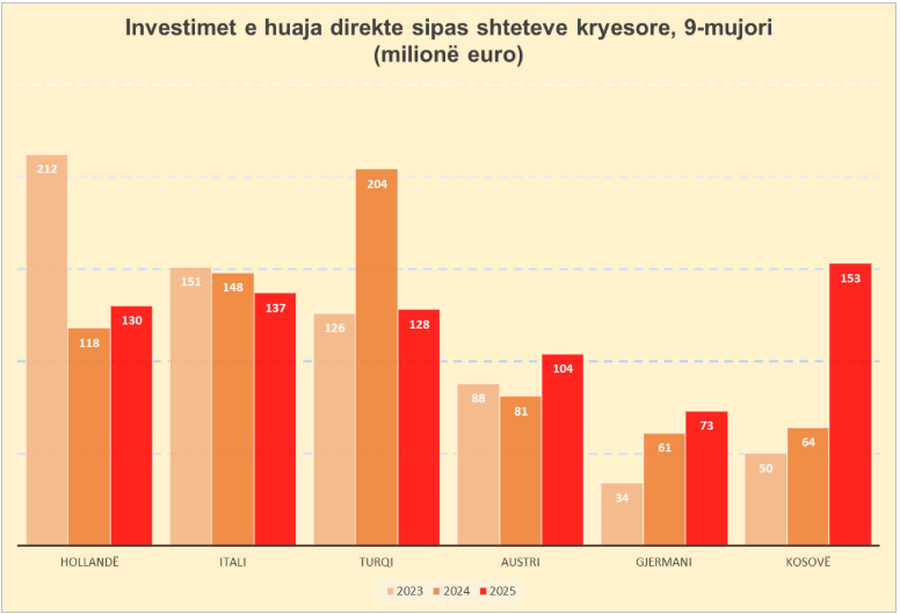

For the entire 9-month period, direct investments from Kosovo reached 153 million euros, an increase of 139% compared to the same period a year ago.

The increase in investments from Kosovo is mainly related to several important acquisitions of enterprises from Kosovo in the Albanian market.

In July, the Kosovo company Viva Fresh closed the acquisition of the second largest retail chain in Albania, Spar Albania. According to the contract signed between the parties, the operation was worth 36.4 million euros.

Viva Fresh owns the largest retail chain in Kosovo and is owned by businessman Xhevdet Rexhepi. The chain is present in retail activities in Kosovo and North Macedonia, through the brands Viva Fresh Store and Super Kit Go.

Meanwhile, in early September, the Kosovo-based company ALBI Holding finalized the acquisition of the clothing retailer Fashion Group Albania (FGA) from the Albanian business group Balfin. The transaction value was around 7.6 million euros.

The purchasing company Albi Holding is part of Albi Group, which owns a network of fashion stores of several international brands in Kosovo and North Macedonia.

Another important acquisition was made in the last quarter of the year, when the company KAN shpk publicly announced the acquisition of Global Fast Food Albania, the company that owned the rights to the global fast food brand, KFC for Albania. KAN, for its part, owns the rights to this brand for Kosovo, North Macedonia and Montenegro. With the acquisition of Global Fast Food Albania, KAN will control the KFC brand in the Albanian market as well.

KAN is a company registered in Kosovo, with sole owner businessman Fatmir Zymberi. His business group has been present in Albania for years, through the company Scandinavian Living, which owns the rights to use the Danish brand Jysk for Albania and other countries in the region.

The stock of investments from Kosovo at the end of 9 months of 2025 reached 550 million euros, an increase of 42% compared to the same period a year earlier.

The second largest investor for 2025 is Italy, with a total inflow of 137 million euros for the first 9 months of 2025. Italian investments have decreased by 7.4% compared to the same period a year ago and are oriented especially towards service activities.

The Italian investment stock at the end of the third quarter has already reached 1.84 billion euros, up 10.5% compared to a year earlier.

The Netherlands has dropped to third place among foreign investors for 2025. The value of Dutch investments for the first 9 months of 2025, however, increased to 130 million euros, 10% more compared to the same period a year earlier.

Meanwhile, the stock of Dutch investments has reached a value of 2.68 billion euros, an increase of 8.7% compared to the same period a year ago.

However, excluding Shell (which ceased operations in Albania last year), the high values of Dutch investments in recent years are mainly related to the fact that the Netherlands is one of the preferred countries in Europe to register holding companies, in order to control the international investments of various business groups. The Netherlands is preferred for registering offshore companies, is because the legislation there guarantees a high degree of confidentiality regarding share ownership, but also because it has an extensive network of agreements with other countries in the world to avoid double taxation.

Another important foreign investor remains Turkey. For the first 9 months of 2025, new investment flows of companies with Turkish capital reached 128 million euros, but with a decrease of 37% compared to the same period a year earlier.

Meanwhile, the stock of Turkish investments at the end of September 2025 reached 1.35 billion euros, an increase of 11% compared to the same period in 2023.