The Competition Authority opened an in-depth investigation into the mobile market at the end of 2025, motivated by the concentration of the market in two operators and the increase in the price of communication packages. However, the financial indicators of the companies for the last decade show a modest performance and low profits. In the long term, such a performance makes it difficult to support new investments, ensure a high quality of service and make the market less attractive for investors.

The Competition Authority decided at the end of last year to open an in-depth investigation into the mobile services market. The opening of the investigation is related to the increase in the price of mobile communication packages in recent years and the change in the market structure.

The Albanian market, in the last decade, has entered a phase of gradual concentration, with the number of operators decreasing from four to two.

The reduction in the number of operators has increased concern that the presence of fewer service providers will lead to higher prices, and in fact, such a trend has begun to emerge after 2022.

However, it must be said that the process of market concentration in just two players was the result of deteriorating financial indicators and a market structure that was not sustainable in the long term. Fierce competition and the constant need for investment for more than a decade led to a drastic decline in companies' profits.

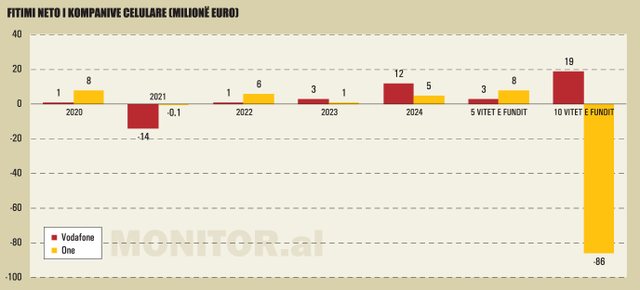

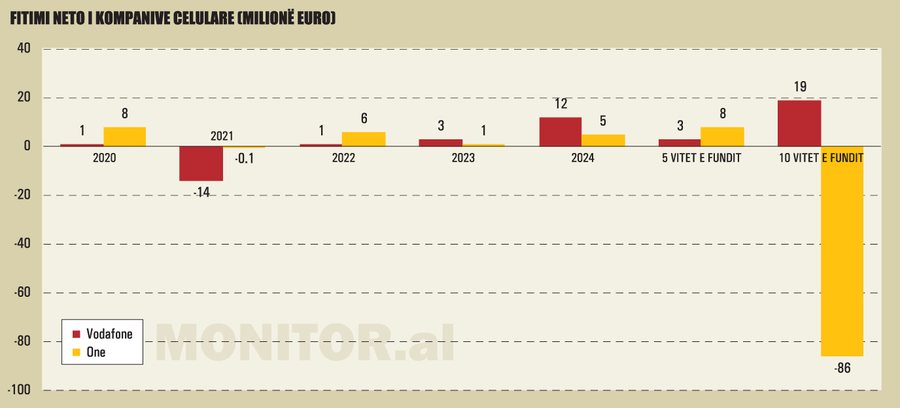

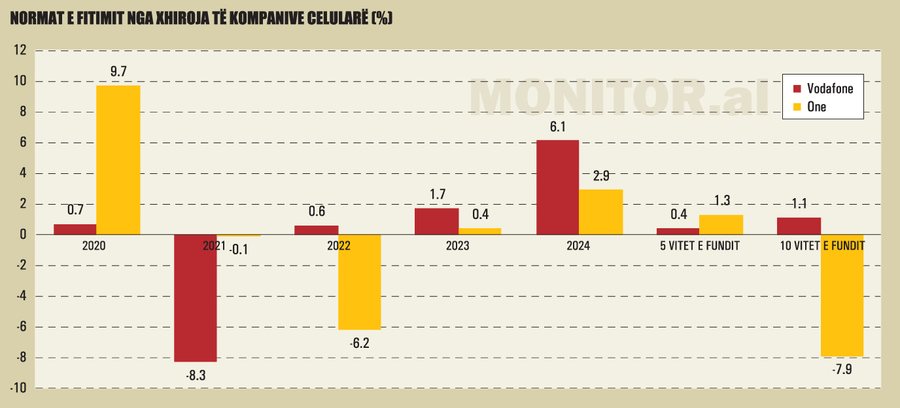

According to financial statement data, the profits secured by operators in the last decade have been disappointing.

In the last ten years (until 2024), the EBIT profit (earnings before interest and taxes) of the two mobile companies has been only 9 million euros, while the final net profit, after taxes, has been negative, with losses worth 67 million euros.

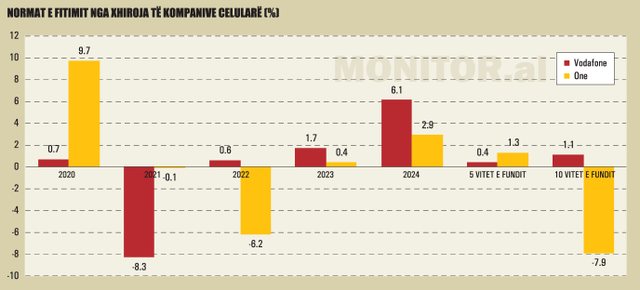

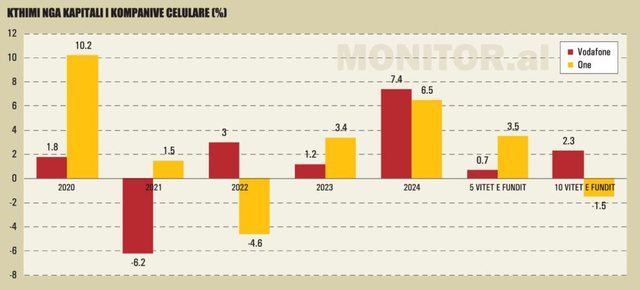

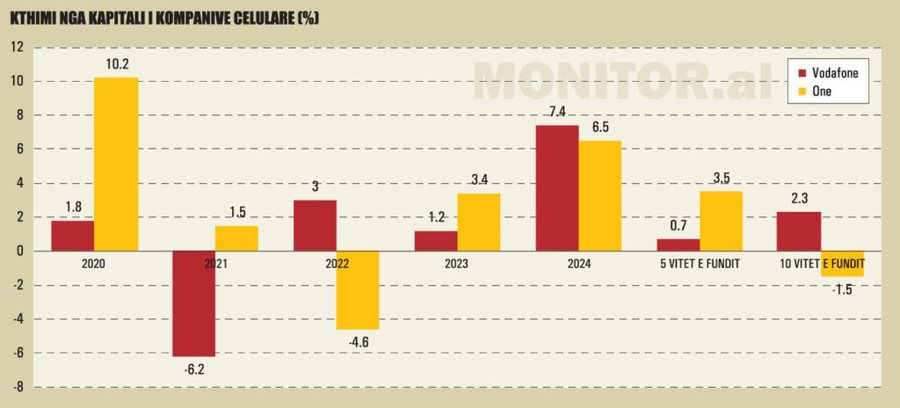

In absolute terms, Vodafone Albania has recorded a net profit of 19 million euros over the last decade. This translates into a profit margin of only 1.1% and a return on invested capital of 2.3%.

For One Albania, the net financial result of the last decade has been negative at the value of 86 million euros, with a negative net profit margin on turnover, at -7.9%, and a return on equity also negative, at -1.5%.

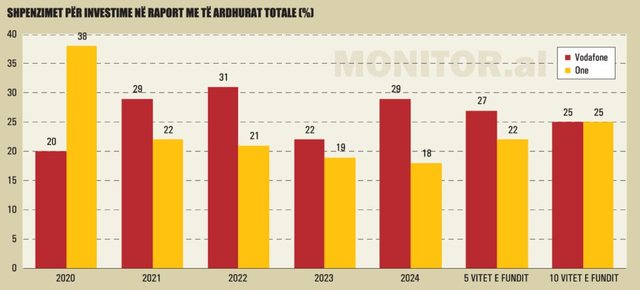

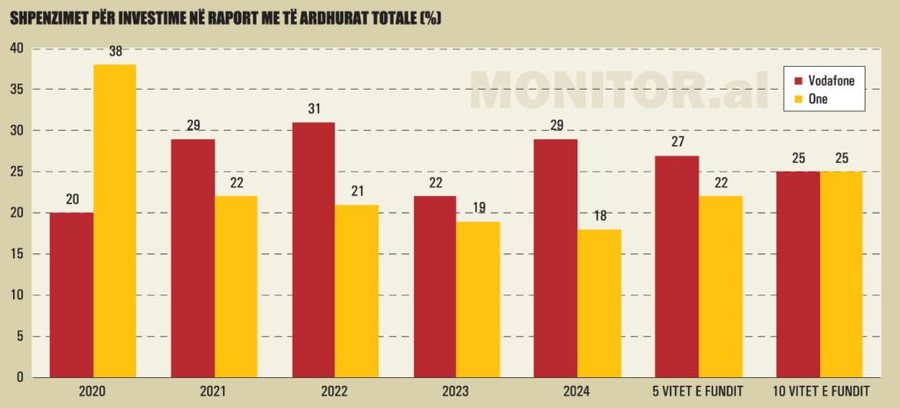

However, based on financial statement data, the capital intensity indicator, which measures capital expenditures in relation to total revenues of operators, has averaged 25% for the last decade.

This indicator appears to be above what is accepted as the benchmark level for this industry, in the range between 15% and 20%.

In the last 10 years, the value of investments of two mobile companies, Vodafone Albania and One Albania, in the last decade reached 586 million euros.

The two companies that exited the market, Plus Communication and Albtelecom, resulted in losses from mobile services activity throughout their existence.

Such performance can hardly support the long-term financial health of companies and guarantee the necessary investments related to the maintenance and increase of network transmission capacities, the rapid depreciation of technological assets over time, as well as the leapfrogging of 5G technology.

In the short term, increased competition can bring benefits to consumers, through lower prices, and in special cases even "predatory" prices, with the aim of expanding the customer base or maintaining this base, by the relevant operators.

Such a market structure cannot be sustainable in the long term, because it tends to erode the profitability of operators, reduce resources and incentives for increased investment, and generally make the market less attractive to investors.

In fact, AKEP, as a sectoral regulator, had expressed concern about competition with economically unjustified prices and had threatened intervention if such a practice continued.

In addition to the failure of the two smaller operators, Deutsche Telekom's exit from the Albanian market in 2019 illustrates the fact that this market has become less attractive to important strategic investors.

High costs and the need for intensive investment fundamentally make mobile markets natural oligopolies: within this typical structure, the “right” number of actors in the long run is determined by market equilibria.

An important element in this regard may also be the size of the market. Albania is a relatively small market, with a decreasing trend in the number of inhabitants and consequently, in potential users of mobile services.

The last census of 2023 counted a population of only 2.4 million inhabitants, a significant decrease from the population of 2.8 million that was registered in the 2011 Census. The small size of the market determines higher costs per unit and makes it difficult to benefit from the mechanism of economies of scale.

Changing market structure is improving financial performance

Data from the last available year, 2024, shows that the change in the structure of the mobile services market has begun to bring improvements in the financial performance of companies.

For 2024, Vodafone Albania reported a net profit of 12 million euros, up from 3 million euros a year earlier. The net profit margin improved to 6.1%, up from 1.7% in 2023. Meanwhile, return on equity increased to 7.4%, up from 1.2% a year earlier.

One Albania reported a net profit of 5 million euros for 2024, up from 1 million euros in 2023. The profit margin increased to 2.9%, up from 0.4% a year earlier. Return on equity also improved to 6.5%, up from 3.4% in 2023.

However, the profit and return rates of this sector are still quite low relative to the optimal returns expected by investors in a healthy market.

Current returns on capital (respectively 7.4% for Vodafone Albania and 6.5% for One Albania) are still below the cost of capital, which operators currently estimate at 10%. Returns on investment are also significantly lower than other strategic service sectors in the economy.

Of course, maintaining effective competition is important and regulators must play their role in protecting it and consumer interests.

But, on the other hand, the electronic communications market may need to consolidate its performance, in order to be an attractive sector for stimulating new investments, promoting innovation and being a solid link in an increasingly digitalized environment of products, services and work processes.

A good financial health of operators is also important in the dimension of maintaining and increasing quality human resources. Labor markets, especially in profiles related to technology and communication, are increasingly globalized.

The Albanian market has clearly experienced competition in recent years in many of its sectors, resulting in the involuntary departure of young professionals or their remote engagement with foreign companies.

In such an environment, the good financial health of companies is a necessary prerequisite for investing in human resources, as the main foundation of long-term business success.

Banking sector experience

Under certain circumstances, a market concentration process may not necessarily be a negative development, especially in those markets where large capital commitments are required.

The Albanian economy has witnessed a similar trend in the banking market. After 2015, a cycle of bank mergers and acquisitions began in the market, which gradually reduced the number of active banks from 16 to 11.

This cycle helped create larger, healthier banks that were more willing to take on risk and finance the economy. Lending rates to the economy accelerated and in 2024 reached their highest rates in 16 years.

The non-performing loan ratio has also gradually declined to a 16-year low. Overall, the sector consolidation cycle has had a positive effect on the economy, increasing businesses and households' access to financing, which has supported the expansion of consumption and investment.

In fact, from global experience, consolidation is a typical trend even in mobile services markets.

Generally, after an initial phase of increasing the number of operators, which in Europe lasted approximately until 2010, these markets have gradually tended to move back towards concentration, through acquisitions and mergers between operators.

Such a trend has been observed in most markets in Europe and the Region. Consolidation can offer several advantages, such as a healthier structure for long-term development and helping to increase operational efficiency.

A more concentrated market structure can discipline pricing policies, avoiding "predatory" pricing practices and attempts to gain market share at the expense of financial health.

Improving financial parameters would create even more space for innovation and new investments and support economic development, as an essential pillar of its digitalization.

Communication services are vitally important, in an era when human society is increasingly relying on technology and digitalization.

The digitalization of services and processes has an essential link: communication and interaction, which is enabled precisely by electronic communications operators. The more the digitalization of public and private services progresses, the more the need for fast, reliable, but also secure communication capacities increases.

In recent years, the risk of cyberattacks has become increasingly tangible. Investing in the security of systems and networks is as important as their development, updating and maintenance.

Even for the public sector, a more sustainable telecommunications sector is a more reliable partner for digitizing services, building an intelligent infrastructure, and meeting national connectivity objectives.

On the other hand, encouraging long-term investments by operators requires a more stable legal and regulatory environment. Periodic surveys with representative business associations highlight the instability of the regulatory and fiscal environment as one of the main concerns.

While expectations and demands for mobile operators are always high, the bureaucratic environment still creates obstacles to their activity.

Mobile operators complain that they encounter difficulties and long delays in obtaining the necessary permits to erect new antenna towers, which would further improve the quality of signal coverage of the territory.

In Albania, there are still no real incentives for new technologies, such as Artificial Intelligence, the Internet of Things (IoT), and 5G technology as an essential link for access to virtual services that would foster innovation.

Such incentives may be useful to partially offset the constraints resulting from the small size of the market and the relatively low level of average income.

The Competition Authority opens an in-depth investigation into companies

The Competition Authority opened an in-depth investigation into two mobile service providers in the country, Vodafone Albania and One Albania, at the end of 2025.

As it had warned in October, during its reporting to the Albanian Parliament, the Competition Authority, during the preliminary market investigation phase, has concluded that there may be elements of anti-competitive behavior in this market.

The in-depth investigation will cover the time period from January 1, 2022 to November 18, 2025.

In justifying the decision, the Competition Authority states that the retail mobile services market in Albania appears as a duopoly, where the two operators in question jointly own 100% of the market.

This structure indicates high market concentration and a limited level of effective competition, creating favorable conditions for collective dominant positions.

From the preliminary investigation that covered the period from January 1, 2022 to July 25, 2025, it was found that the companies Vodafone Albania and One Albania have followed similar commercial behavior in relation to their mobile service offers, including prepaid, postpaid packages and roaming services.

During this period, the Competition Authority notes a progressive and almost synchronized increase in prices, while it does not appear that these enterprises have used a cost calculation methodology that would justify the changes in prices applicable in the market.

The analysis of price developments shows that whenever one of the operators has increased the prices of mobile packages, the other operator has followed within a short period of time with a similar increase, both in price level and in the structure of the package (minutes, internet, SMS, validity, etc.).

This indicates an immediate and symmetrical reaction, which can be interpreted as a coordinated practice, within the meaning of the Law "On the Protection of Competition".

Analysis of the offers shows that the packages offered are almost identical in price and content (internet amount, national minutes, roaming inclusion, etc.), significantly limiting the choice for consumers and reducing competitive pressure between operators.

This homogeneity of products, combined with the lack of transparency in costs, poses a risk of coordination of the behavior of enterprises, aimed at maintaining a stable level of prices and profits in the market.

The Competition Authority emphasizes that none of the companies has submitted documentation to prove that the prices were calculated based on an analysis of the real costs of the services.

In the absence of a clear methodology, price increases may be considered economically unjustified and the result of behavior oriented towards pursuing a common commercial model, rather than towards competition through innovation or efficiency.

However, operators have argued that the redesign of the prepaid and postpaid plan portfolio has come about organically, based on the analysis of internal and external factors, internal cost analysis, network investments, spectrum purchases, adoption of 5G technology and macroeconomic market conditions.

Operators also argue that they have experienced a significant increase in costs and tightening of contract conditions, as a result of the knock-on effect and transmission of inflation in their agreements with third parties.

However, in conclusion, the Competition Authority states that, in conditions where the market presents a duopolistic structure, there is a synchronization in price increases and offers that are almost identical in price and content, there is a lack of transparency and cost-price methodology, then the behavior of the companies Vodafone Albania and One Albania may constitute a violation of the law, "On the Protection of Competition"./Monitor.al/