The 2026 draft budget comes this time with a slight shift in budgetary policy towards human capital, combining fiscal sustainability with increased spending on salaries, pensions, and infrastructure investments.

The 2026 budget does not introduce new taxes, but increases revenues through the indirect effects of wage increases, inflation, and formalization.

The state stands to gain the most, as the greatest burden is borne by employees and consumers, while large businesses will only bear a small portion of this increase.

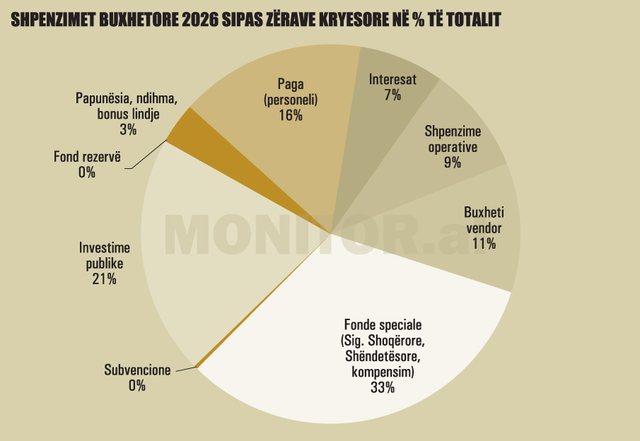

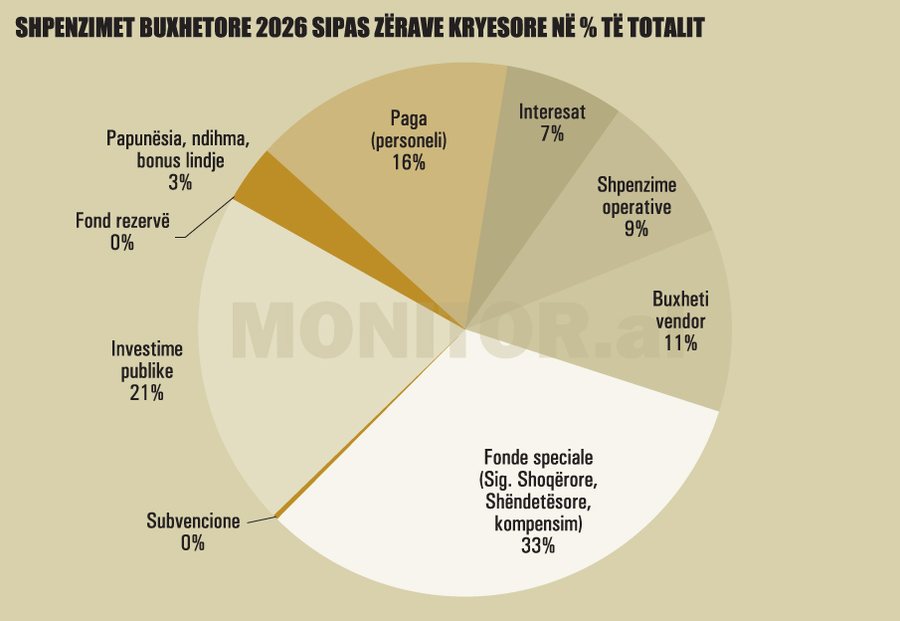

On the other hand, about a third of the total expenditure of 886.7 billion lek goes to social protection and public sector wages in 2026, while spending on education and health together does not exceed 4.6% of GDP, a level that remains significantly below the regional average, where these sectors reach 6–7% of GDP.

The breakdown of budget expenditures indicates an orientation of fiscal policy towards the immediate management of social costs, instead of structural investments that generate long-term productivity.

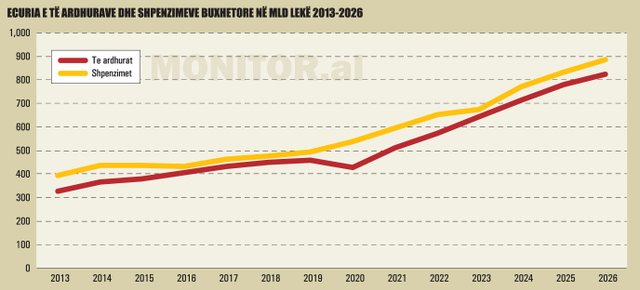

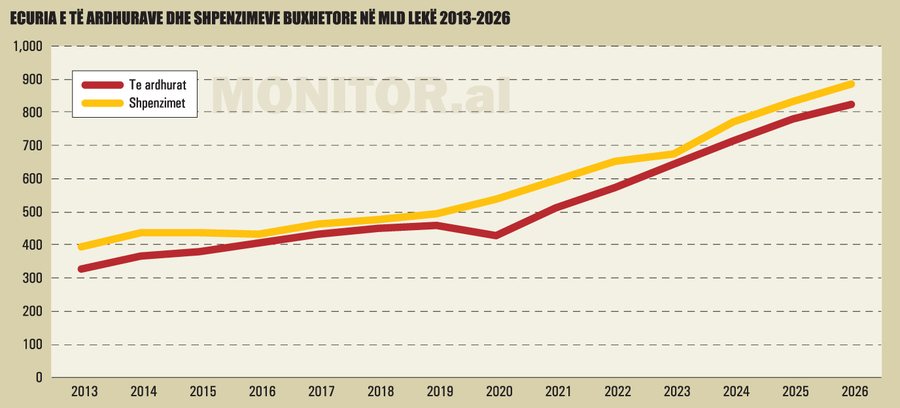

Budget revenues are expected to reach 823.7 billion lek, an increase of about 53 billion lek or 7% more, which is expected to be supported by wage increases and the formalization of the labor market.

In this way, the government aims to return to citizens a portion of the economic growth achieved in the last two years, without increasing public debt, as the budget deficit remained at 63 billion lek, with an increase of about 2% from this year.

The balance between revenue collection and distribution has improved, due to a more aggressive policy for increasing pensions.

Social spending and public wages now account for more than half of the total budget, while capital investments are held at 6.5% of GDP.

This budget aims for a social transition that seeks to bring Albania closer to regional standards.

Who will pay more in 2026?

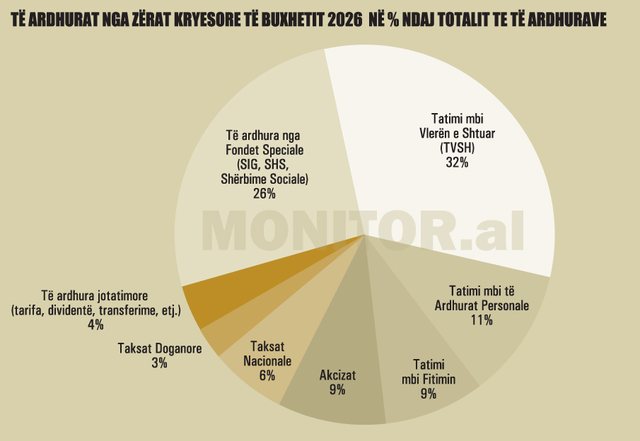

The 2026 draft budget foresees a significant increase in revenues, which will reach 823 billion lek, or 29.6% of GDP.

Compared to 2025, budget revenues are expected to be around 53 billion lek more, an increase that comes more from wage increases, inflation, and formalization than from expanding the fiscal base.

The main burden of income growth will be borne by employees and consumers, while large businesses will contribute to a more limited extent.

Wage growth, the strongest source of new income

About 28% of the additional revenue of 53 billion lek in 2026 is expected to come from the effect of the increase in the minimum wage from 40 to 50 thousand lek, which comes into effect from January 1, 2026.

This policy is the main generator that increases revenue in 2026.

The effect of tax/budgetary measures such as salary indexation in public administration and the increase in the minimum wage is about 11.82 billion lek, of which about 9 billion lek from the increase in the minimum wage and 2.79 billion lek from salary indexation in public administration.

Also, another amount of 3.6 billion lek will be the positive effects from the increase in collections from TAP as a result of the increase in the minimum wage.

In total, insurance contributions will reach 196.9 billion lek, an increase of 11.4% compared to 2025.

This means that most of the additional revenue will come from employed taxpayers, who are paying more due to rising wages and expanding the insurance base.

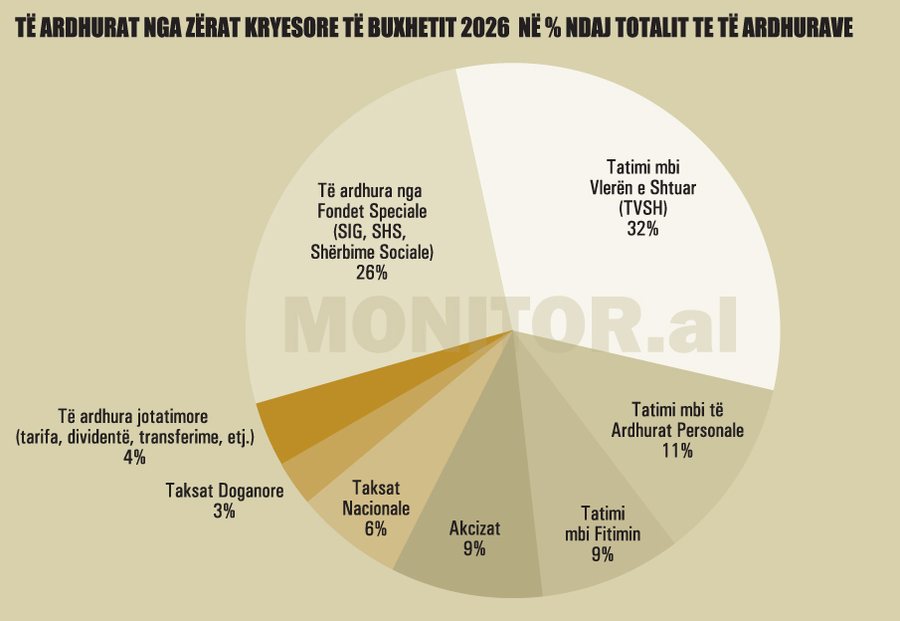

VAT, the largest source of revenue

Value Added Tax (VAT) remains the most important source of revenue. For the 2026 draft budget, net VAT is expected to reach 242.5 billion lekë, an increase of 7% compared to 2025.

This item is covered mainly by domestic consumption, so any price increase or expansion of household spending immediately translates into more revenue for the state.

Increased inflation (3%) and economic growth (4%) are estimated to add over 20 billion lek in revenues, while the Medium-Term Revenue Strategy (MTRS) and digital administration will provide another positive effect of around 11 billion lek.

Even in this category, consumers are the main contributors to income growth, through taxes on the prices of goods and services.

Profit tax, only technology is affected

The profit tax for 2026 is projected at 65 billion lek, with an increase of 7.8%.

This comes mainly from the normalization of installment payments after a weak year in 2025, as well as from the removal of the 5% reduced rate for the technology sector, which will be taxed at 15% from January, a measure that adds about 0.5 billion lek to the budget.

Meanwhile, personal income tax (PIT) reaches 88.3 billion lekë, an increase of 4.9%, thanks to the increase in the number of employees and the increase in salaries. Again, the main impact comes from employed individuals, not from businesses.

These data show that direct taxes from companies remain a limited contributor to total revenues and that the potential for growth is still untapped.

Excise and consumption taxes, the burden on consumers again

Excise taxes, which include fuel, cigarettes and beverages, will bring in 74.7 billion lek, about 3.7 billion more than a year ago.

The increase comes from the implementation of the new tobacco calendar, the periodic indexation of excise duty levels, and the effects of increased fuel consumption.

Here, the increased fiscal burden is once again borne by consumers, through higher prices of basic products in the basket.

Customs duties, decreasing

In contrast to other revenue items, customs duties are projected at 10.3 billion lek, a 7.3% decrease compared to 2025, due to changes in the origin of imports and a decrease in the quantity of some processed goods.

This indicates a lower dependence on imports and a more modest impact of international trade on the state budget.

Albania, still below the regional average

Although the collection trend is positive, Albania remains below the regional average.

With 29.6% of GDP in budget revenues, the country is 3–4 percentage points lower than Serbia, Montenegro or North Macedonia, which reach an average of 33–35% of GDP.

The IMF estimates that Albania's potential is at least +2.5% of GDP more, if the measures of the Medium-Term Revenue Strategy are fully implemented and if wealth taxation and VAT are reformed.

Expenditures, a budget that encourages consumption

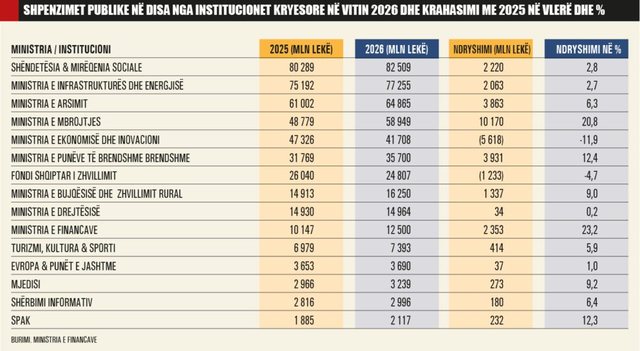

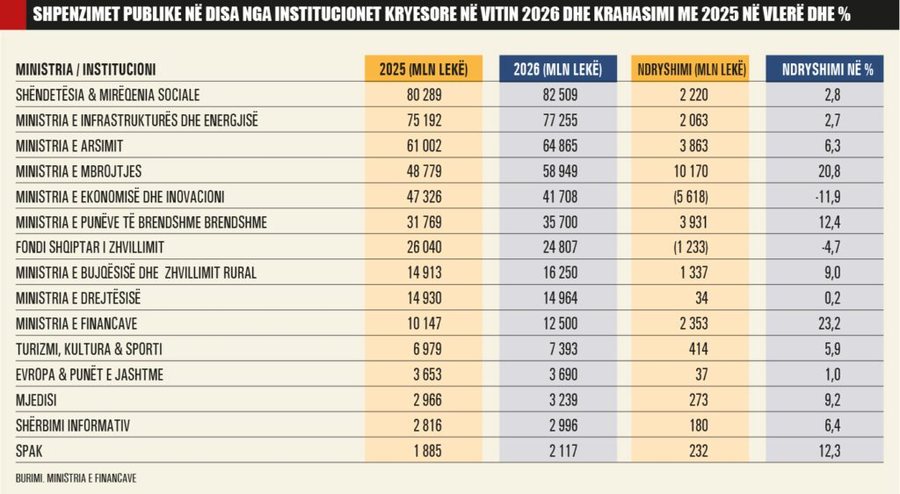

Budget expenditures amount to 886.8 billion lek, about 55 billion lek more than in 2025.

The vast majority of the growth belongs to wages, pensions and social transfers, while spending on education, health and innovation maintains minimal growth rates.

Wage increases, the most costly initiative of the year

The largest increase on the expenditure side is related to the increase in the minimum wage to 50 thousand lek and the 2.5% indexation of salaries for public administration.

The total cost of this decision is estimated at around 10 billion lek, while the fund for central personnel salaries alone reaches 140.1 billion lek, which constitutes 5% of GDP.

Relative to GDP, this is the highest level of wage spending since 2017 and includes increases in the education, health, and police systems.

Social protection and pensions, one third of the budget

Social protection spending amounts to 204.1 billion lek (7.3% of GDP), the highest level in history for this item. The pension indexation fund is 1.65 billion lek, while the monthly bonus for pensioners amounts to 10 billion lek.

On the other hand, economic and disability assistance remains at 23.9 billion lek, the same as a year ago, signaling the intention to maintain the stability of existing social programs, without further expanding the number of beneficiaries.

The fund for former political prisoners (1.5 billion lek) and birth bonuses (2.3 billion lek) are also added, reflecting the demographic support policy.

Capital investments 1.8 billion euros, but low yield

The government maintains a high level of public investment of around 1.8 billion euros. In the last 10 years, the government has been aggressive with ever-increasing funds for public investments, but on the other hand, the country's problems have still remained unresolved regarding road infrastructure, sewage and water supply.

The International Monetary Fund has pointed out that Albania has low efficiency of public investments and they are usually oriented towards facilities with no impact on improving the quality of life.

The main focus for the period 2026 – 2028 remains on strategic projects in transport, energy, digitalization and security, in line with the European Union's Growth Plan for the Western Balkans.

The largest investments are foreseen in the new Port of Durres, which does not yet have a winning company, and the rest will be distributed in Corridor 8 and the North-South Corridor.

Another portion of the funds will be used to improve road and rail networks, water supply and sewage systems and rural development, as well as to complete regional hospitals in Shkodër, Fier, Lushnje and Pogradec.

16% of the 2026 budget, for debt interest and operating expenses

Interest expenses are projected at 64.2 billion lek (2.3% of GDP), or 7.2% of total budget expenditures, including a safety reserve of 6.3 billion lek to protect against the risks of fluctuations in interest rates and exchange rates.

Meanwhile, the operational and maintenance expenses of central institutions are projected at 81 billion lek (2.9% of GDP) or 9.1% of the total budget to be used to support farmer schemes, maintain national roads, employment promotion programs, cybersecurity, and promote economic development, education, and sports.

Municipalities receive 11% of the 2026 budget

Local budget expenditures will be 97.7 billion lekë, increasing by 9% compared to 2025. Their share in the economy will reach 3.52% of GDP, compared to 3.4% in 2025 and 2.3% in 2015. In 2026, the local budget accounts for 11% of total budget expenditures from the 10% it occupied in 2025.

The unconditional transfer to municipalities will be 27.8 billion lek, while the total funds that will be transferred from the state budget to local governments will reach 47.3 billion lek, about 9.7% more than a year ago.

This includes 13.8 billion lek in sectoral transfers for new functions, 5.5 billion lek for salary increases, and 200 million lek in performance grants to boost performance in local government.

Education, minimal funding, without a new structural reform

The education budget includes only an increase in teacher salaries and modest funding for school infrastructure. For 2026, 64 billion lek will be financed for education, which is 7.3% of total budget expenditures.

Although the “School of the Future” program is mentioned as a priority, there is no visible increase in funding for curricula, scientific research, or instructional technology.

The report highlights support for free books and some social inclusion programs, but lacks a broad strategy for vocational education and university digitalization, areas that have been identified by the EU as essential for economic integration.

In percentage terms, public education in Albania remains below 3% of GDP, an indicator that does not meet the national objective of the Development and Integration Strategy 2021–2030, which aims for 4.5% by the end of the decade.

Healthcare, partial improvements, without real capacity increase

In the field of health, the budget foresees 82.3 billion lek, with an increase of 2.8% compared to 2025. The innovations are focused on oncology drugs, financing of breast reconstruction interventions, and limited investments in regional hospitals and maternity hospitals in Lushnja, Fier and Shkodra.

However, most of this fund is used for operating expenses and salaries, not for equipment, technology, or modern infrastructure.

At a time when the health system faces a shortage of specialists, emigration of doctors, and outdated infrastructure, the budget remains more corrective than transformative.

The drug reimbursement fund is planned at 13.5 billion lek, a significantly higher level than the funds foreseen for previous years.

This fund aims to cover the reimbursement of medicines for patients belonging to health insurance schemes, including chronic and specialized medicines, in addition to oncology medicines.

However, even with this increase, the country's real needs for medicines remain high. Albania has a significant prevalence of chronic diseases such as diabetes, hypertension, cardiovascular diseases and oncological diseases, which require a continuous supply of medicines.

Reports from the FSSH and health institutions show that often, current funds do not fully cover demand, leading to shortages of medicines in pharmacies, or delays in treatment./Monitor.al/