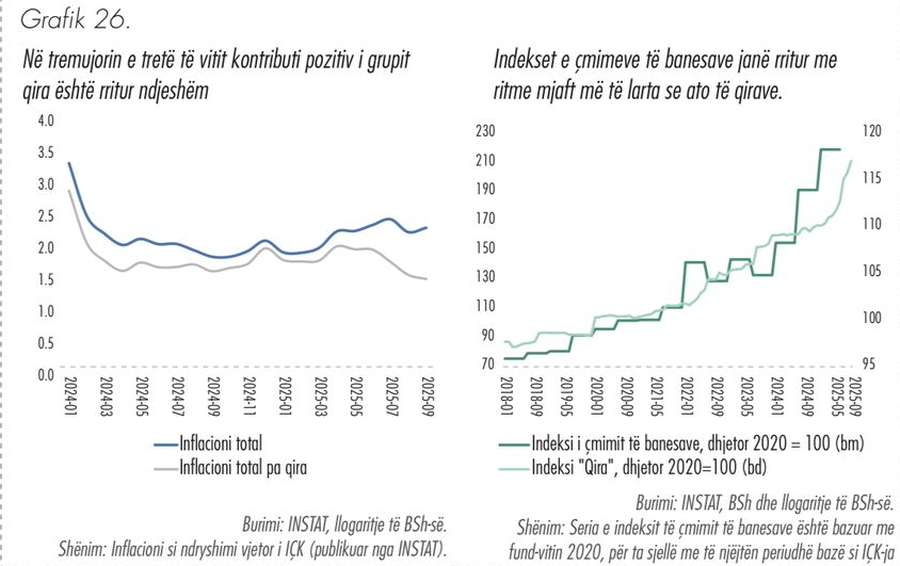

The housing market in Albania is experiencing a long phase of price growth, which is being reflected with increasing intensity in the rental market. The latest analysis of the Bank of Albania shows that the increase in housing prices, which started at a strong pace since the end of 2020, has created pressure on rental rates, leading to a significant acceleration of housing service inflation.

According to the data, the housing price index has been steadily increasing, reaching historically high levels in the third quarter of 2025. This increase is the result of a combination of factors, starting from strong domestic demand and numerous investments by emigrants, to construction costs, which have increased continuously due to materials, wages and market pressures. A significant part of real estate purchases continues to be generated by strong investment demand, which considers the housing market more favorable than deposits or traditional savings instruments. Consequently, housing prices have increased at higher rates than any other subcategory of the real estate market.

The effect of this increase has already begun to be clearly transmitted to the rental market. The Bank of Albania notes that rental inflation during the third quarter reached 5.8 percent, a rate that is about three times the average of the previous year and over two and a half times higher than the average for the years 2021–2025. This increase has led to an expansion of the contribution of rents to total inflation, which has risen to 0.8 percentage points, from only 0.3 percentage points in the previous period. This is a significant change, which places rent among the main factors driving overall inflation in the country.

The increase in rents has not occurred in a vacuum, but is a natural reaction to the steady increase in housing prices. The rental market usually lags behind changes in the sales market, as it takes several contract renewal cycles for landlords to update prices in line with the new market reality. However, the pressure does not come only from the supply side. Demand for rent has remained high, especially in large cities, where population flows from other areas of the country, the increase in the number of students and the increasing presence of foreign workers are creating additional pressure on existing capacities. This leads to a natural upward trend in rental rates, which is now clearly measured in official statistics.

Although rents have increased, their dynamics still remain more moderate compared to the increase in housing prices. The Bank of Albania chart clearly shows that housing prices have followed a significantly steeper trajectory, increasing faster and more strongly in recent years. This creates a kind of gap, where rents only partially follow the pace of real estate price growth. However, the third quarter of 2025 marks one of the moments when the rental market is showing the strongest growth historically, which signals that this gap may start to narrow in the future.

In the analysis of the Bank of Albania, the contribution of rents to inflation is expected to remain high in the coming months. This is because rental rates have a greater natural inertia than other service groups and do not experience immediate fluctuations. Moreover, the high demand in the urban market and high housing prices show no signs of decreasing, creating the conditions for a sustainable pressure in this market segment.

Overall, the housing market panorama shows a clear pattern of pressures: housing prices continue to rise rapidly, rents are accelerating and inflation is directly increasing, while the tourism-related services market remains exposed to high costs. This situation suggests that the housing market in Albania is entering a more complex phase, where real estate price developments have the potential to affect not only the private housing sector, but also macroeconomic policies and the inflation rate at the national level. /ekofin.al