Albania's government is ready to forgive businesses' more than a decade-old tax debts as part of what it calls a reset of relations between tax authorities and businesses. Critics say it is unfair to those who have played by the rules.

Ndoci, a 60-year-old restaurant owner in northern Albania, prides himself on doing everything according to the law, paying bills on time and keeping tax officials happy.

Therefore, when the ruling Socialist Party announced last year that it would forgive tax debts of businesses older than a decade, Ndoci saw this as a stab in the back.

“I have worked according to the rules since 1992; I pay insurance and all tax obligations,” Ndoci told BIRN, on condition that his last name not be published.

"But when I see that competing businesses that are not regular, that don't pay their bills like mine, will be amnestied by the state, this not only creates inequality, but also pushes me to do the same."

“Instead of supporting and favoring businesses that regularly pay taxes, they are forgiving businesses that operate 'under the rug.'”

The debt amnesty is expected to come into effect this month, after it was first announced by the Socialist Party during its election campaign in the spring of 2025.

But it's not just Ndoci who is angry. Several ruling party MPs have expressed skepticism over the government's refusal to publish the names of the businesses that will benefit.

“The assembly needs to know – who are we doing this honor to?” asked Socialist lawmaker Erjon Braçe during a session of the parliament’s Committee on Economy, Employment and Finance.

Deputy Minister of Finance, Endrit Yzeiraj, said that such “sensitive” information cannot be made public and the finance ministry has not responded to BIRN’s questions regarding the businesses that will benefit.

Enno Bozdo, a lawmaker from the opposition Democratic Party, said the state is simply rewarding lawbreakers. “This is neither fair nor justified,” he said.

"Amnesty" or "agreement"?

In mid-November, Minister of Finance Petrit Malaj presented two draft laws: “On the Cancellation, Extinction and Payment of Tax Liabilities to the Central Tax Administration and of Duties Payable to Customs” and “On the Fiscal Peace Agreement”.

He rejected the term “amnesty,” saying the goal was simply to improve relations between taxpayers and the tax office – creating a “fiscal peace,” as the government called it.

The second law, “On the Fiscal Peace Agreement,” is designed to help businesses manage their newest debts through a voluntary agreement with the state that will last for the next two years and will partially forgive these debts.

Under the first, debts dating back more than a decade will be completely canceled; a partial cancellation of newer debts will be possible for businesses that start paying them this year.

According to government data, the state is owed just over 300 million euros in unpaid taxes dating back more than a decade. The latest debts total more than 1.3 billion euros. In office since 2013, Prime Minister Edi Rama's Socialists have proposed amnesty before.

In 2022, Rama's cabinet proposed allowing Albanian citizens to legalize undeclared assets worth up to two million euros in exchange for paying a 5-10 percent tax, without having to disclose the source of the assets. The opposition said the beneficiaries would be criminals, and the proposal never became law.

A similar scheme proposed in 2020 was withdrawn after pressure from the European Commission and the International Monetary Fund, who argued that it could aid money laundering.

Rama said that the "new fiscal agreement" would be implemented.

"The fiscal agreement promoted during the election process is now a written package designed to strengthen cooperation and increase trust between the tax administration and business," he said.

Jorida Tabaku, an economist and MP for the opposition Democratic Party, said it was an amnesty in disguise and that it differed little from the amnesties proposed in 2020 and 2022.

“First, we need to be honest with the terminology: what the government calls a ‘fiscal agreement’ is essentially a disguised fiscal amnesty,” she told BIRN. “It is the same concept that the government backed away from four years ago, following clear opposition from the European Union, which warned that such an amnesty would weaken anti-money laundering controls and would not help improve tax compliance.”

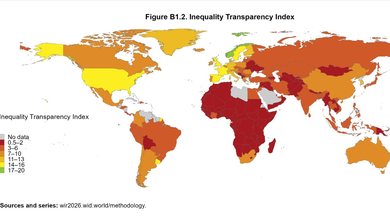

Tabaku argued that the initiative would “violate the equality of enterprises before the law” and risk damaging the Albanian economy and its international reputation.

"And here the fundamental question arises: who benefits? Are they government-linked companies, concession beneficiaries, entities investigated by SPAK, or businesses that have lived for years in the shadow of informality?"

Unknown consequences

The American Chamber of Commerce has criticized the government's plan, saying it risks undermining the principle of equality before the law, legal certainty, the proportionality of tax obligations, and the administration's obligation to treat all taxpayers equally.

"The draft law proposes a scheme in which businesses that have correctly declared profits over the years are placed in a disadvantageous position, while entities that have evaded tax obligations directly benefit," it said in a statement issued on December 11.

Ola Xama, an economics journalist, told BIRN.

"What is the social effect of 'fiscal peace'? None, it has no social effect because it does not support the needy and vulnerable segments of society."

She also questioned the analytical basis of the initiative, noting that "we don't have the names of the beneficiaries."

Zef Preçi, head of the Albanian Center for Economic Research, said the impact of the initiative is "difficult to predict," but could be detrimental to business competitiveness in the long term.

"So, even if it may mark a momentary increase in the collection of fiscal revenues in the state budget over the next one or two years, the implementation of this 'agreement' is estimated to further worsen the business climate in the country, harm competitiveness in various markets and turn the country into a fiscal paradise," Preçi told BIRN.

"The government must be transparent to the interest group that is demanding this legal act (business, the government itself, its oligarchic clients, or organized crime directly)," he added.

“The refusal to publish the list of beneficiary businesses hides a dubious reality and fuels speculation, when, in fact, the opposite should have been the case.”/BIRN/