Only time will tell whether the planned projects in the future will manage to materialize, or will remain on paper due to lack of financing or falling demand. But, as always in Albania, forecasting remains a difficult equation due to an unknown variable, that of informal flows.

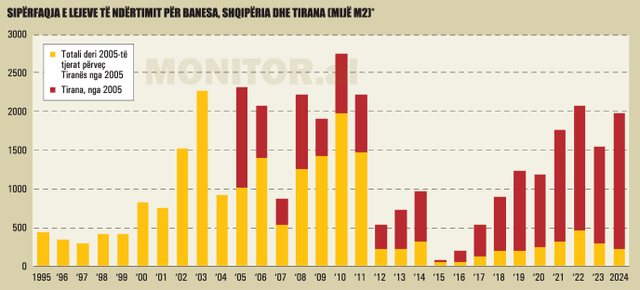

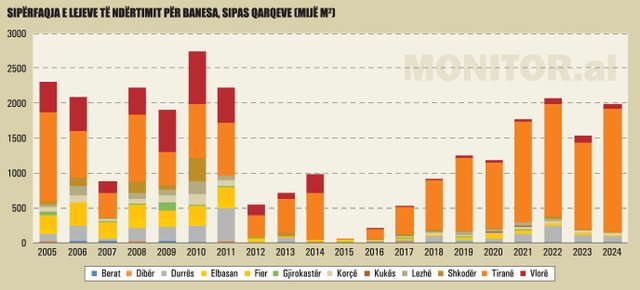

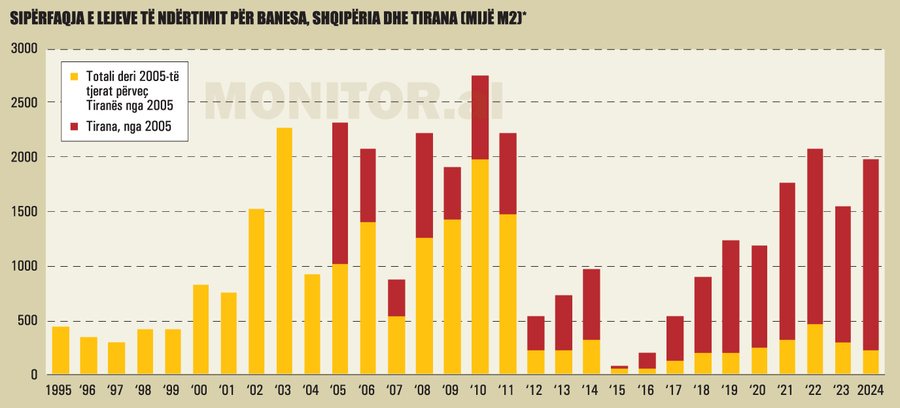

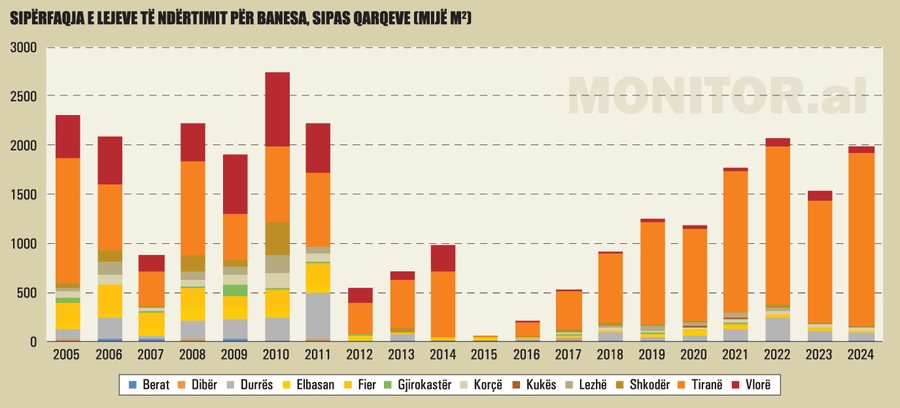

From 2019, the area granted for building permits in the country began to increase rapidly, peaking in 2022 – 2024, when 1.5 – 2 million square meters of area were granted for building permits across the country for residential purposes.

This is the second cycle of construction in the country. The first began after 1997, as population movements spurred massive construction in the cities of the country's center, mainly in the capital.

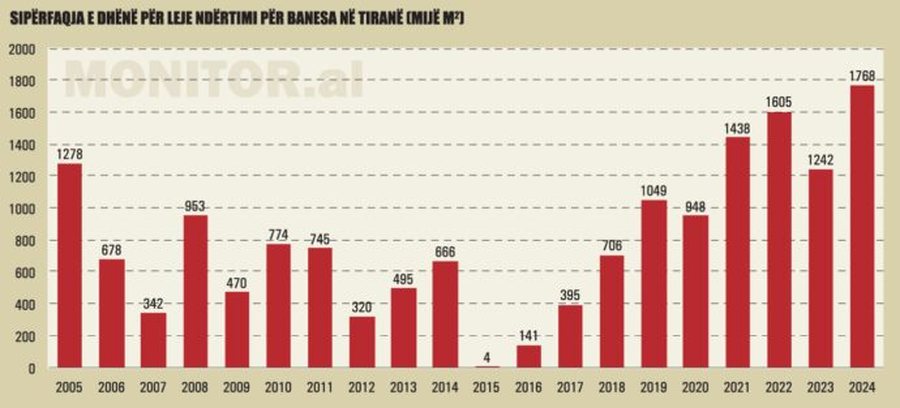

In 2010, the historical record was reached with 2.7 million meters, only to drop in the following years, to only 50 thousand square meters in 2015.

It seemed that the country had passed the emergency phase of construction, with the sector reaching maturity, and businesses even attempted to diversify into other directions, with some even trying investments in livestock farms.

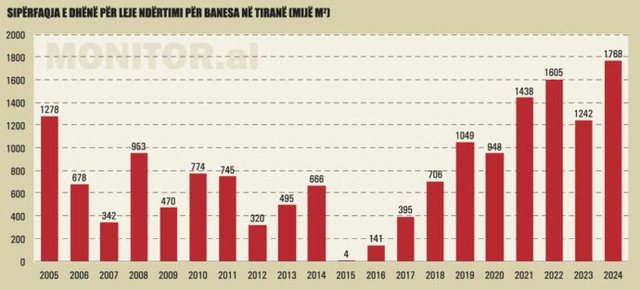

This "calm" did not last long. After 2016, another wave of violence began. Unlike the first cycle, which was spread across the country, the focus was now only on the capital.

For example, in 2010, Tirana received only 28% of the surface area of permits issued for housing, Vlora, 27.7%; Shkodra 11%; Durrës 8%. In 2011, Tirana received the same 28%, Vlora 18%, Durrës 11%.

In 2022 – 2024, 70-80% of the areas were given for permits in the capital. In 2024, the record of permits ever given for Tirana was even reached, with 1.76 million square meters.

Has the sector reached a new maturity?!

The last two years have given some signals. Prices have increased rapidly, curbing demand. In the center, apartments have reached a high point of 4-6 thousand euros/m² and inside the Ring Road, at 2000-3000 euros/m².

The increasing cost of living in the center has shifted demand to the outskirts, triggering a new wave of price increases. The cheapest apartment in Tirana now costs an average of over 1,400 euros/m².

The signals from the market are that foreign demand for properties is also falling, as a result of their rapid price increase. In recent years, apartments on the coast, especially in the South, have also seen double-digit price increases due to high demand.

Maximum sales prices for apartments on the coast have reached up to 4,000 euros/m², with purchases by foreigners becoming an important factor in boosting the market, especially on the coast.

With real estate lending reaching 27% of all lending in the country, the Bank of Albania has shown signs of concern.

In July 2024, the Bank of Albania decided that the countercyclical capital surcharge (KUNC) rate for Albania will be 0.25 percentage points, from zero as foreseen in the previous decision, which was met by banks until June 2025.

As of July 1, 2025, the Bank of Albania imposed new limits on housing loans: for the first home, financing cannot exceed 85% of the property value in Lek (75% in foreign currency) and the monthly installment must not exceed 40% of income (35% in foreign currency); for the second home, the limits are 80%/35% in Lek and 70%/30% in foreign currency.

The maximum term is 30 years or until retirement, while banks can only exceed the limits for 15% of new loans in special cases.

According to the Bank of Albania, the implementation of these limits will enable the reduction of the risk of borrower failure and the reduction of banking losses associated with these loans, as a result of possible unfavorable developments in real estate prices or in the country's macroeconomic framework.

According to Central Bank statistics, by the end of June 2025, the active loan portfolio for the purchase of housing reached the value of 230.1 billion lek, an annual increase of 17.4%.

Demographic developments have not been in favor of the real estate market for years. The latest Census data found that Albania's population has decreased by 460 thousand inhabitants, or about 16%, in the last decade.

Other findings are not optimistic either: About 40% of apartments are found to be empty; the 15-19 age group has halved in a decade; the number of women of reproductive age has fallen by 28.4% from 2011 to 2023, which warns of a further contraction in births.

The municipality of Tirana, the largest in the country, which is a center of gravity compared to others for internal migration, is not seeing rapid population growth.

According to the 2023 Census, there were 758 thousand residents in the capital, only 8 thousand people more than in the 2011 Census.

In 2025, the population grew by only 1.7 thousand people, reaching 759.9 thousand inhabitants.

This actual increase in the capital's population is not good news for builders in the capital, who have built on erroneous projections so far, with data that Tirana is growing by 20-25 thousand inhabitants per year.

The maturation actually seems to have set in. The growth of construction activity has slowed in 2023 – 2024 and operators claim that rising prices have curbed demand.

The informal currency has been an important factor that has boosted the construction and real estate market, both in supply and demand, but SPAK's investigations have "scare off" these entrants, according to statements from real estate agents, and some of the projects are unknown whether they will start, or worse, whether those that have started will be completed.

Demand or not, the growth in construction seems set to continue, at least according to the papers.

In three meetings in the first half of 2025, the National Territorial Council has granted permission for multi-story projects in the capital, high-rise hotels, and residential areas.

While we have yet to see the materialization of the permits granted in 2024, it takes at least two years for them to begin to materialize.

Only time will tell whether the projects planned in the future will manage to materialize, or will remain on paper due to a lack of funding or a decline in demand.

But, as always in Albania, forecasting remains a difficult equation due to an unknown variable, that of informal flows. /Monitor/