Buying an apartment in the capital has become an impossible mission for many individuals, who earn their income through salaries in both the private sector and the public administration. Apartment prices in recent years have increased at a much faster rate than salaries, extending the time it takes to work to secure your own home.

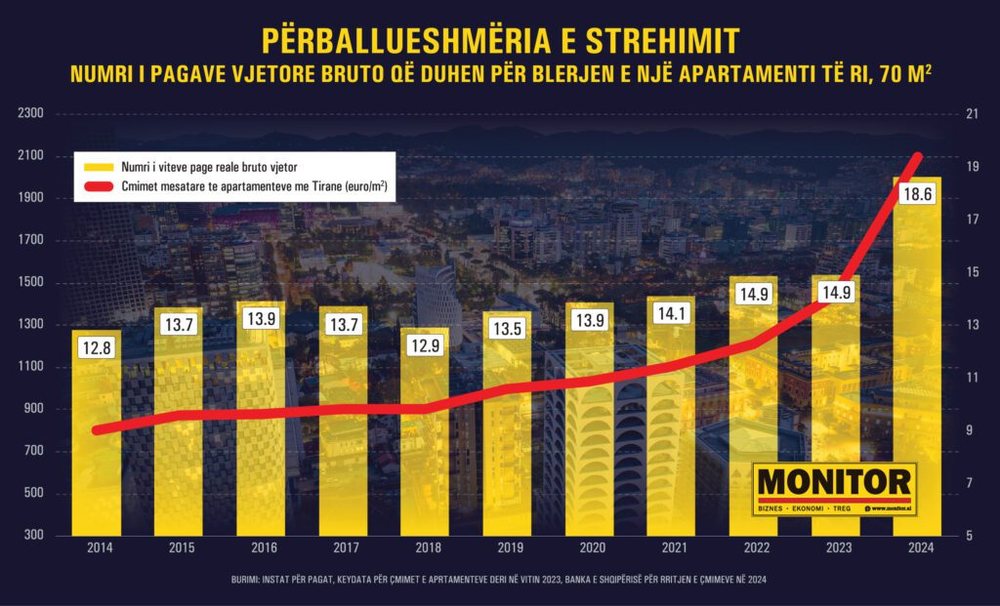

"Monitor" has calculated the housing affordability indicator, or purchasing power for a home, which measures how much real gross annual salary is needed to purchase a new apartment, with a standard size of 70 square meters.

In 2014, an apartment cost an average of 820 euros per square meter, according to data from KeyData, a unit that tracks apartment sales and prices in the capital. In that year, the average real salary (indexed with inflation, with the year 2020 as the base) was about 51 thousand lek, according to official INSTAT data. A 70 square meter apartment cost about 56 thousand euros.

In that year, the exchange rate was at the buyer's disadvantage, as the euro was exchanged for an average of almost 140 lekë and as a result, an apartment, converted into the local currency, cost about 8 million lekë. To buy a house, an individual needed to work for an average of 13.1 years.

In 2024, the average price of an apartment in Tirana was 2,100 euros per square meter, or almost three times higher than a decade earlier. Price increases have been particularly rapid in the last three years, averaging 30-40% per year , according to data from Keydata through 2023 and the Bank of Albania, which measures the annual change in apartment prices according to the Fischer index, in 2024.

A 70 square meter apartment costs 147 thousand euros, up from 56 thousand euros a decade ago. Although the average salary has reached 77.5 thousand lek/month, the average real salary (indexed with inflation, which measures real purchasing power) was 66.1 thousand lek, due to the strong price increase in recent years, which causes the salary to be spent more quickly on the purchase of the same products.

An advantage for the buyer in 2024 is the decline in the euro, which was exchanged for about 100.7 lekë, as an annual average, according to the Bank of Albania, which has somewhat amortized the strong increase in apartment prices.

Converted into lek, a 70 square meter apartment costs 14.8 million lek, up from 7.8 million lek a decade ago. To buy this apartment now requires almost 19 real gross annual salaries (18.6), or almost 6 years more than a decade ago.

Calculating with the nominal salary for 2024 (77.5 thousand lek per month), it would take 15.9 years of work to purchase an apartment in 2024.

In practice, this means that a young person or a family relying solely on their income from work finds it increasingly difficult to secure a home. The disparity between the pace of housing price growth and wage growth is deepening the social housing problem, pushing many citizens towards long-term rental or emigration, where the opportunities to buy a home are more real.

The reasons for the rapid increase in housing prices are related to several factors such as the increase in construction costs due to improved quality, the increase in employee salaries, the percentage of the surface area given to landowners, the increase in municipal taxes, such as housing and infrastructure taxes, or the increase in reference prices in the last two years that automatically increased housing and infrastructure taxes, which builders immediately passed on to the price. Another important factor that has driven up prices has been the informal economy, such as money laundering, or the high demand coming from corruption money. An additional element is the country's return to a tourist destination that has stimulated demand from foreigners, but the impact of the latter has been mainly on the coast.

I want a house, I work much longer than in Europe

To provide a more detailed picture of housing affordability, this year’s edition of Deloitte’s Property Index included a comparative analysis of homeownership affordability in selected European cities. Data for Tirana was missing from this analysis, as the capital was mentioned in another indicator as one of the cities with the fastest price increases in Europe.

The assessment is based on cities where both data on average asking prices for new housing and data on average gross wages are available. Affordability is calculated as the number of average annual gross wages needed to purchase a standardized newly built apartment of 70 m2. This indicator provides a clearer understanding of how affordable home ownership is for local residents and highlights affordability differences within and between countries.

According to data collected by Deloitte’s national offices, the least affordable city in this survey is Amsterdam, where residents need 15.4 average gross annual salaries to buy a 70 m² apartment – a slight increase of 0.3 compared to a year ago. It is followed by Athens, with 15.3 annual salaries, while in third place is Prague, where 15 annual salaries are needed for a similar apartment.

In the next level of affordability (14.0–14.9 annual salaries) are cities such as Košice (14.2) and Brno (14.0). In the next group, with 12.0–13.9 annual salaries, are Banská Bystrica (12.8) and Bratislava (12.3).

Qytetet ku përballueshmëria llogaritet mes 10.0 dhe 11.9 pagave vjetore përfshijnë Lubljanën (11.7), Selanikun (11.4), Budapestin (11.4), Ostravën (10.9), Londrën e brendshme (10.8) dhe Roterdamin (10.1).

Në skajin më të përballueshëm të spektrit, banorët e Odense në Danimarkë dhe Torinos në Itali kanë nevojë vetëm për 4.9 paga mesatare bruto vjetore për të blerë një apartament të ri – duke i bërë këto qytete më të përballueshmet në krahasim. Të tjera qytete me përballueshmëri relativisht të lartë janë Mançesteri (5.3), Aarhus (5.8) dhe Katoëice (7.1).

Sipas raportit, është e rëndësishme të theksohet se përballueshmëria e strehimit formësohet jo vetëm nga çmimet e pasurive të paluajtshme, por edhe nga niveli i pagave lokale. Në disa raste, edhe qytetet me çmime të larta mund të ofrojnë përballueshmëri më të mirë falë rritjes së të ardhurave mesatare. Për këtë arsye, balanca mes rritjes së të ardhurave dhe inflacionit të kostos së banesave mbetet një faktor thelbësor që përcakton aksesin në strehim në mbarë Europën.

Duke i përshtatur këto të dhëna me kryeqytetin shqiptar rezulton që Tirana, e matur si me pagën nominale (15.9 vite) ashtu dhe me atë reale (18.6 vite) është ndër më të shtrenjtat në Europë, e matur me fuqinë blerëse, sipas përllogaritjeve të “Monitor”.

Një vlerësim i ngjashëm është nxjerrë dhe nga njësia e të dhënave krahasuese globale, Numbeo, sipas të cilit Shqipëria Një familjeje mesatare shqiptare i duhen mesatarisht 16.3 vite pune për të blerë një apartament. Kjo kohë është më e gjata në të gjithë Europën, sipas treguesit Numbeo, që llogarit indeksin e çmimit ndaj të ardhurave, që mat përballueshmërinë e blerjes së një apartamenti, për mesin e vitit 2025.

Në vende ku këta tregues janë të lartë, strehimi shihet si i papërballueshëm, çka lidhet me rritje të kostove të jetesës, vështirësi për të rinjtë që të blejnë një shtëpi dhe shpesh me shtim të emigracionit. Ky indikator përdoret gjerësisht për të vlerësuar krizën e strehimit dhe presionin që kanë qeveritë për të ndërhyrë me politika mbështetëse, si subvencione, kredi të buta apo rritje të ofertës së banesave të reja.

Ndërsa në Shqipëri, ndër më të varfrit e Europës për të ardhurat për frymë dhe pagën minimale e mesatare, treguesi i vetëm që po përdoret është “mburrja” se është rritur vlera e pronës, apo se çmimet e apartamenteve do të dyfishohen kur vendi të hyjë në Bashkimin Europian! / Monitor